Efficient and stress-free implementation of the Instant Payment Regulation with our cloud-based test platform

The deadlines of the Instant Payment Regulation are here faster than you think. Unifits has the perfect solution to save precious time while significantly increasing the quality of your instant payment implementation.

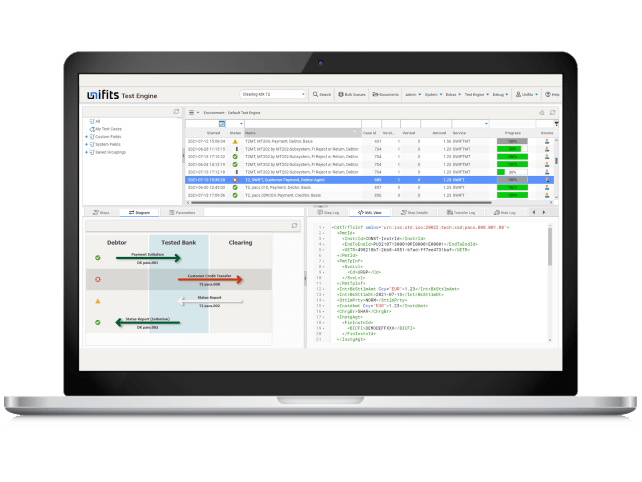

With the innovative, cloud-based Unifits testing platform, you can effortlessly execute all instant payment processes and ensure compliance with the instant payment infrastructures TIPS and RT1 in the shortest possible time – quickly, efficiently and stress-free.

Find out more and start making the most of the time you have left today.

Under immense time pressure due to the Instant Payment Regulation?

The implementation of the Instant Payment Regulation presents significant challenges for many financial institutions. With Unifits, you set new standards in efficiency and quality for realizing your payment strategy.

Our well-proven solution for automating transaction tests in payment systems saves valuable resources, enables faster project completion, and significantly improves the quality of your payment project.

Benefits

Warum Unifits?

The Unifits Test Engine eliminates the need for costly and time-consuming implementations by integrating the required payment expertise from the start. This allows you to begin productive testing from Day 1 and immediately benefit from our solution.

With our years of expertise and specialized solution, we enable banks to meet the strict requirements of the Instant Payment Regulation on time and smoothly, while simultaneously maximizing the efficiency and precision of your testing processes.

Time Savings

Automated and effortless tests that save valuable resources and shorten project timelines.

High Quality

The precision and efficiency of the Unifits Test Engine set completely new quality standards for testing payment processes.

Proven Technology

Benefit from a mature software solution and its clearing simulators, which have been successfully used by leading banks for years.

Future-Proof

Unifits continuously adapts the simulators and rule sets to new versions and changing regulations, ensuring you are well-prepared for future requirements.

Functionality

How it works

Step 1: Get informed with no obligation

- Learn more about our solution and use our test portal as a “quick-win” solution from Day 1.

Step 2: Schedule a demo

- See the Unifits Test Engine in action and discover how you can fully automate your Instant Payment tests and effortlessly repeat them anytime.

Step 3: Start quickly

- Begin today and make the best use of the remaining time.

Voices

What Our Clients Say

Compatibility

Supported payment schemes

The Unifits Test Portal complies with the guidelines of a wide range of clearing schemes for a large variety of payment systems throughout the world, e.g. Real-Time payments, High Value payments, Mass & Retail payments). Unifits is constantly introducing new schemes and not all available schemes might be listed on this page or unlocked in Free Mode in the Unifits Test Portal. So please just let us know in case you are interested in a particular scheme.

- Global: SWIFT CBPR+

- Europe: TARGET2

- Europe: EBA EURO1

- Europe: EBA STEP1

- United Kingdom: CHAPS

- Switzerland: SIC4

- Europe: TIPS TARGET INSTANT PAYMENTS

- Europe: EBA RT1

- Nordics: NPC Instant Credit Transfer

- Europe: EBA STEP2 (SEPA Credit Transfer, SEPA Direct Debit Core & B2B, SEPA Cards Clearing)

- Nordics: NPC Credit Transfer

- Germany: SCL SEPA-Clearer German Bundesbank

- Canada: LYNX

- United States: TCH CHIPS (as from Q2/2022)

- United States: Fedwire (as from Q2/2022)

- Canada: RTR Real-Time Rail (as from Q3/2022)

- United States: TCH RTP

- United States: FedNow (as from Q3/2022)

- Singapore: MEPS+

- Hongkong: CHATS (as from Q4/2022)

More payment schemes on request: we are happy to introduce particular schemes, if needed

Contact us now