Customer Onboarding for a new age

The Customer Onboarding Platform is much more than just a portal to validate whether messages are compliant to a particular scheme or not.

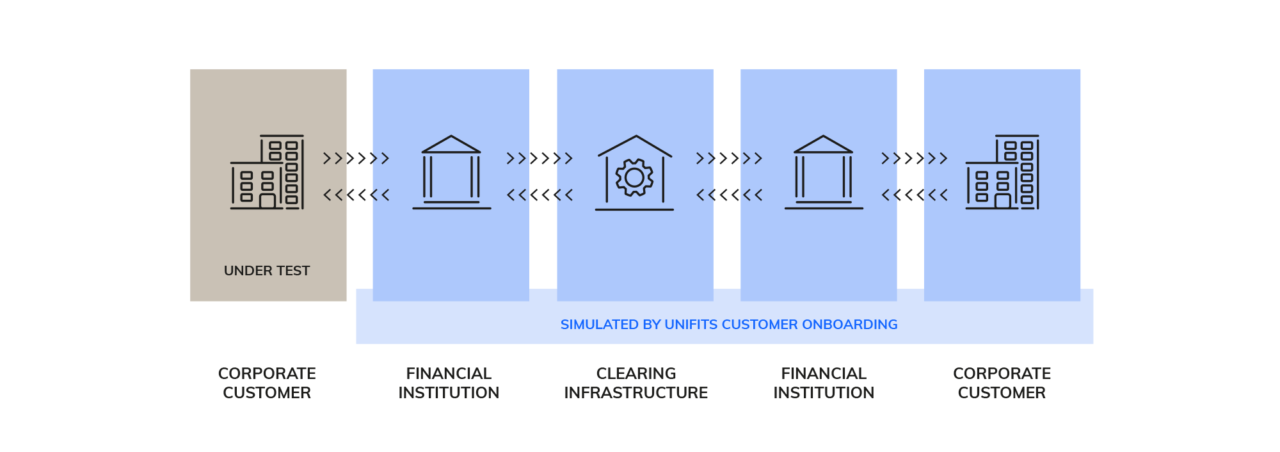

No doubt, just providing validation capabilities makes sense in the early stages of a modernization program. But as soon as the loop within a payments ecosystem is going to be closed, and corporate customers should be provided with enriched cash and account management reporting (camt), a validation portal reaches its limits. Thus, more elaborate simulation facilities are necessary to satisfy a corporate customer’s demands for their own testing. With the virtualized booking engine, the Unifits Onboarding Platform is ready to meet this challenge.

The best news however is that you don’t have to worry about all of that. Choose Unifits as your provider and benefit from a decade of experience with ISO 20022, test support and test automation. You will start with a lightweight Validation Portal and expand according to your needs.

With our modular concept, your investments are secured. Based on that approach we have the flexibility to provide customized solutions with unbeatable time to market. Moreover, costs can be reduced, and quality can be increased by reusing centralized components.

Our Customer Onboarding Platform provided by Unifits allows every software partner or bank client, who is affected by the Swiss payment migration, to conduct independent testing.

Besides the fact that Unifits’ solution increased our efficiency for client onboarding by factors, it added enormous value to our clients by giving them a 24 / 7 “self-service” that saved their efforts and at the same time improved the overall end to end processing quality.

Unifits’ passion for ISO 20022 and quality assurance combined with the great collaboration and their outstanding solutions made the partnership a pleasure.

KEY CHALLENGES

What the Customer Onboarding tackles for you

- Corporate customers are very demanding and expect support from their bank

- Verification of payment initiation messages is complex, time-consuming and error-prone

- Supporting customers with their ISO 20022 onboarding requires efforts from specialists who are already heavily loaded

- Providing client report messages to support customer testing is almost impossible to do manually

- Usually there is a long time span between the customer’s request and a qualified reply from the bank

Key FEATURES

What the Customer Onboarding can make possible

-

Validates for all types of order transmissions

-

Simulates client reporting through a virtualized booking engine (pain, camt, MT)

-

Simulates incoming transactions (to test, how they are going to be reported)

-

Provides self-registration and ease to use with no training required

-

Secure and reliable, attested through external penetration testing

- Comprehensive statistics give you full transparency on the testing progress of your corporate customers

Benefits

ISO 20022 testing simplified – at a glance

Effortless for banks: No more effort for the bank thanks to an unattended, self-service oriented test portal – smooth go-live with customers and reduced operational risks.

.

Immediate results: No time lag between customer request and response due to the immediate availability of test results.

Raised transparency: The Unifits Customer Oboarding allows for a higher level of transparency during the customers testing progress due to comprehensive statistics.

Satisfied customers and great added value: Let us quote one of our customers: “Unifits has added tremendous value to our customers by providing them with 24/7 self-service that has significantly reduced their efforts while improving overall quality.”

Simplify onboarding for corporate customers

- Significantly accelerated onbarding to your e-banking

- Effortless self-service and end-to-end testing for your customers

- Happy customers due to excellent onboarding support

Frequently asked questions

Can our own rules be applied when validating payment initiations?

Sure, the definition of validation rules for Unifits solutions is extremely flexible. Adaptations and additions to rule sets can either be carried out by yourself or you can receive them directly from Unifits as a service.

How are my customers authorized or set up to use the platform?

Unifits offers three options for this and thus full flexibility. The user can register himself without his bank having to intervene. The second option is that the bank just approve the user after registration. And the third option is that the bank takes over the creation of the user completely.

Where is the Customer Onboarding Portal hosted and operated?

The Customer Onboarding Portal can either be hosted by you or Unifits offers this as a service. Unifits operates cloud services exclusively in very secure data centers certified to run financial services applications and with sensitive data.