Lack of test resources and time to complete testing cycles will never again be an issue.

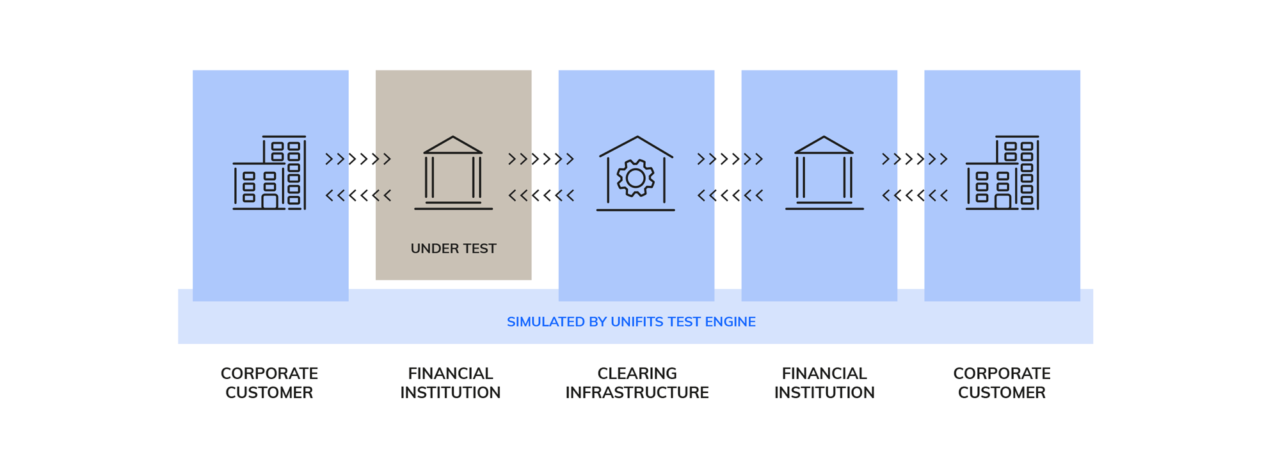

The Unifits Test Engine is the first solution of its kind with extensive industry-specific knowledge already embedded. Simulators for all types of payment clearing and settlement infrastructures turn your test environment into a mirror image of production.

These simulated test counterparts, combined with two highly specialized engines for controlling business processes and applying validation rules, enable independent, continuous automated testing of the entire payment cycle, ensuring your interoperability with all the payment ecosystems you connect to. All tedious, time-consuming and error-prone tasks are replaced by this powerful combination, resulting in an exceptionally helpful yet easy-to-use solution. Your specialists are finally relieved and are available for more value-added tasks in your demanding project plan.

Unlike other solutions to automate testing, the Unifits Test Engine needs almost no setup and implementation time. This is achieved in several ways. One example is by using predefined test cases. Adjusting relevant data, such as account numbers, to a particular environment is also not an issue.

Key Challenges

What our Test Engine tackles for you

- Increasing complexity within payments industry

- Accelerated innovation and development cycles with shorter time-to-market

- Lack of key resources with required know-how

- Demanding and time-consuming requirements in terms of test reporting

KEY Features

What our Test Engine can make possible

- Automated end-to-end transaction testing

- Comprehensive test reporting

- Extremely smart solution to cover test case variants

- Continuous testing 24/7/365

- Supports all types of payment processes whether it be real time or batch, high-value or mass payment

The benefits of the Unifits Test Engine at a glance:

Benefits

ISO 20022 testing simplified – at a glance

Massive test acceleration: The Unifits Test Engine is a best-of-breed solution that accelerates test execution and significantly reduces test resources.

Fully automated, ready to go: With built-in domain knowledge and no scripting required, the Test Engine can start working for you right away.

Improved quality, reduced risks: The tedious and error-prone creation of test messages is eliminated, and field-by-field checks are also handled by the test engine. The result: greatly improved test quality with reduced operational risks.

One application, all payment types: The Unifits Test Engine enables test automation for all different types of payment transactions. No matter whether they are related to high-value, real-time, bulk or correspondent banking payments.

Accelerate and simplify your transaction testing

- Independent, continuous automated testing of the overall payments cycle

- Interoperability with all connected payment ecosystems

- Reducing time, headcount and all hassle

Compatibility

Supported payment schemes

The Unifits Test Engine complies with the guidelines of a wide range of clearing schemes for a large variety of payment systems throughout the world, e.g. Real-Time payments, High Value payments, Mass & Retail payments. Unifits is constantly introducing new schemes and not all available schemes might be listed on this page or unlocked in Free Mode in the Unifits Test Portal. So please just let us know in case you are interested in a particular scheme.

- Global: SWIFT CBPR+

- Europe: TARGET2

- Europe: EBA EURO1

- Europe: EBA STEP1

- United Kingdom: CHAPS

- Switzerland: SIC4

- Europe: TIPS TARGET INSTANT PAYMENTS

- Europe: EBA RT1

- Nordics: NPC Instant Credit Transfer

- Europe: Switzerland SIC5

- Europe: EBA STEP2 (SEPA Credit Transfer, SEPA Direct Debit Core & B2B, SEPA Cards Clearing)

- Nordics: NPC Credit Transfer

- Germany: SCL SEPA-Clearer German Bundesbank

- Canada: LYNX (in progress)

- United States: TCH CHIPS (as from Q2/2022)

- United States: Fedwire (as from Q3/2023)

- Canada: RTR Real-Time Rail (as from Q3/2023)

- United States : TCH RTP (in progress)

- United States : FedNow (as from Q4/2022)

- Singapore: MEPS+

- Hongkong: CHATS (as from Q1/2023)

- Australia: HVCS

More payment schemes on request: we are happy to introduce particular schemes, if needed

Contact us nowFrequently asked questions

Will the Unifits Test Engine be installed on-premises or is it available as a cloud solution?

Both are possible, but most of our customers opt for the on-premises variant of the Test Engine. One reason is that there are multiple and sometimes easier ways to connect the systems on site. Another reason is usually that banks prefer to keep their data on-site, despite Unifits’ extremely high security standards, because it is almost impossible to avoid working with production-related or personal data at least in part during testing.

How do the Unfits Test Portal and the Unifits Test Engine differ or complement each other?

The Unifits Test Portal and the Unifits Test Engine are complementary solutions. While the portal solution offers unbeatably simple ad-hoc validation and creation for test messages, the test engine is aimed in particular at the permanent automation of end-to-end tests relating to payment transactions. Both solutions have their justification, even in parallel operation. It is quite common for banks to use the Test Portal first, where essential pain points are solved immediately – and this really means “immediately”, and to introduce the Test Engine in a second step. For further details and recommendations based on your specific requirements, please feel free to contact us – we are happy to support you!

How to connect the Test Engine to my payment testing environment?

Unifits offers all industry standard connectivity options. The most frequently requested options are File Share, MQ Series and Active MQ and, at the customer/bank interface, additionally File Transfer and EBICS (Electronic Banking Internet Communication Standard). Connection via web services / APIs is also increasingly in demand due to the open banking trend. Of course, APIs are not an issue either, since the architecture of the test engine itself is also service-oriented and the internal communication of these services is realized on the basis of APIs. This means that if required, even any internal Test Engine service can also be exposed as an API for external use.

How does the Unifits Test Engine differ from or complement DevOps tools like Jenkins and ALM tools like HP ALM, JIRA, Silk, etc.?

The Unifits Test Engine is complementary to such DevOps and ALM tools and not a replacement for them. Of course, this also applies vice versa. The Test Engine can interact with these solutions via APIs, e.g. test cases can be triggered and test results can be queried. Entire test cycle reports can also be transferred so that, for example, compliance with internal documentation obligations is ensured. Again, such DevOps and ALM tools are in no way substitutes for the Test Engine, because the Test Engine contains an enormous amount of business logic, making it a specialized tool for effortless automation of end-to-end testing in payments processing. Feel free to contact us for details, we are happy to support you!

I already use test automation tools such as Selenium or Tricentis, why should I use another one?

The diversity and complexity of IT landscapes has become too great, far too great, so there is no one-fits-all solution to automate software testing! A more generic solution like Selenium or Tricentis might work for almost everything. But considering only functionality does not tell the whole story on costs and benefits. The Unifits Test Engine is a powerful industry-specific solution tailored to the challenges in a particular area: payment processing and its global transition to ISO. The simulators of test counterparties such as corporate customers and clearing infrastructures available with the Unifits Test Engine are not only extremely useful, but impossible to implement at a reasonable cost with a generic solution. Generic and specific solutions have their respective strengths and thus both have their justification.

Does the Unifits Test Engine support only ISO 20022 XML formats or also other standards and even proprietary formats?

The solution has its origins in the first ISO 20022-based projects in Europe and therefore has a special focus on this standard. Over the years, however, it has become apparent that many banks would also like to take advantage of this unique solution for other standards that are currently still in use. Therefore, the Test Engine now supports not only ISO 20022, but also all SWIFT MT message types and, of course, individual proprietary formats that may persist for many years, especially at the customer/bank interface.